MAE FINAL EXAM

Final Exam Summary

0 of 50 Questions completed

Questions:

Information

You have already completed the final exam before. Hence you can not start it again.

Final Exam is loading…

You must sign in or sign up to start the final exam.

You must first complete the following:

Results

Results

0 of 50 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 50

1. Question

A chart of accounts lists accounts in the following order . . .

CorrectIncorrect -

Question 2 of 50

2. Question

On which of the following accounts do we normally not record depreciation?

CorrectIncorrect -

Question 3 of 50

3. Question

Interest earned on a money market account and credited to your company’s bank account but not recorded on your books . . .

CorrectIncorrect -

Question 4 of 50

4. Question

Which of the following dates is appropriate for a profit and loss statement?

CorrectIncorrect -

Question 5 of 50

5. Question

Total debits must equal total credits. This is the basis of . . .

CorrectIncorrect -

Question 6 of 50

6. Question

Which of the following accounts might be included in an adjusting entry?

CorrectIncorrect -

Question 7 of 50

7. Question

Which of the following is an asset?

CorrectIncorrect -

Question 8 of 50

8. Question

On the accrual basis, revenue is recorded when it is …

CorrectIncorrect -

Question 9 of 50

9. Question

On the cash basis, expenses are recorded when they are …

CorrectIncorrect -

Question 10 of 50

10. Question

Your company gets $5,000 in December to paint a house. The work is done in January. How much revenue is reported on a cash basis in December and January, respectively?

CorrectIncorrect -

Question 11 of 50

11. Question

You receive $80,000 before you do work for a customer. The journal entry to record this transaction is . . .

CorrectIncorrect -

Question 12 of 50

12. Question

When are adjusting entries prepared?

CorrectIncorrect -

Question 13 of 50

13. Question

Your company holds a 90-day note receivable of $10,000 from a customer. The note is dated October 31 and has a 12% interest rate. Your company’s year ends on December 31. How much interest revenue do you accrue on December 31?

CorrectIncorrect -

Question 14 of 50

14. Question

The journal entry to accrue interest revenue is . . .

CorrectIncorrect -

Question 15 of 50

15. Question

Your company sells a product for another company and receives a commission of 10% on sales. By the end of your company’s fiscal year, your company had sales of $200,000 and received $8,000, which was credited to Revenue. How much additional revenue must be recorded this fiscal year?

CorrectIncorrect -

Question 16 of 50

16. Question

When revenue is accrued, what is the effect on assets and income, respectively?

CorrectIncorrect -

Question 17 of 50

17. Question

Which of the following is an accurate description of accrued revenue?

CorrectIncorrect -

Question 18 of 50

18. Question

The balance in Allowance For Doubtful Accounts is important to the calculation of bad debt when bad debt is calculated . . .

CorrectIncorrect -

Question 19 of 50

19. Question

A company with a 5-day workweek pays employees on Friday. Its accounting period ends on Thursday. Gross salary for the week is $10,000. How much salary expense is accrued at year end?

CorrectIncorrect -

Question 20 of 50

20. Question

Which of the following journal entries accrues interest expense?

CorrectIncorrect -

Question 21 of 50

21. Question

A firm with a 6-day workweek pays employees on Saturday. If the firm’s year ends on a Saturday, and gross salary for that week is $12,000, how much salary expense is accrued at year end?

CorrectIncorrect -

Question 22 of 50

22. Question

Your company’s year ends on May 31. On May 1, it borrowed $50,000 for 1 year at 12% interest. How much interest expense has it accrued on May 31?

CorrectIncorrect -

Question 23 of 50

23. Question

With accrued expenses, cash payment follows recording the expense.

CorrectIncorrect -

Question 24 of 50

24. Question

What type of account is Deferred Commissions?

CorrectIncorrect -

Question 25 of 50

25. Question

Your company pays expenses of $50,000 during the year and accrues expenses of $5,000 at year end. What are your company’s total expenses for the year?

CorrectIncorrect -

Question 26 of 50

26. Question

The following information relates to questions 26, 27, and 28:

Rehabilitation, Inc. uses accrual basis accounting. It collects $10,000 in December for a painting job and credits revenue. By the end of December, its year end, the company has completed 30% of the job.How much cash did Rehabilitation, Inc. collect in December?

CorrectIncorrect -

Question 27 of 50

27. Question

The following information relates to questions 26, 27, and 28:

Rehabilitation, Inc. uses accrual basis accounting. It collects $10,000 in December for a painting job and credits revenue. By the end of December, its year end, the company has completed 30% of the job.How much revenue has Rehabilitation, Inc. earned in December?

CorrectIncorrect -

Question 28 of 50

28. Question

The following information relates to questions 26, 27, and 28:

Rehabilitation, Inc. uses accrual basis accounting. It collects $10,000 in December for a painting job and credits revenue. By the end of December, its year end, the company has completed 30% of the job.The adjusting journal entry on December 31 (omitting dollars) is . . .

CorrectIncorrect -

Question 29 of 50

29. Question

Unearned revenue is also known as . . .

CorrectIncorrect -

Question 30 of 50

30. Question

The Cash ledger account is not used in adjusting entries.

CorrectIncorrect -

Question 31 of 50

31. Question

The following information relates to questions 31 and 32:

CBA Co. uses accrual basis accounting. It collects $20,000 in December for a job and credits unearned revenue. By the end of December, its year end, CBA has completed 40% of the work.How much revenue has CBA earned in December?

CorrectIncorrect -

Question 32 of 50

32. Question

The following information relates to questions 31 and 32:

CBA Co. uses accrual basis accounting. It collects $20,000 in December for a job and credits unearned revenue. By the end of December, its year end, CBA has completed 40% of the work.Which accounts does CBA debit and credit in the adjusting journal entry on December 31?

CorrectIncorrect -

Question 33 of 50

33. Question

When revenue is credited, it increases revenue.

CorrectIncorrect -

Question 34 of 50

34. Question

Unearned Revenue is what type of account?

CorrectIncorrect -

Question 35 of 50

35. Question

In accrual basis accounting, “recognized” would mean . . .

CorrectIncorrect -

Question 36 of 50

36. Question

With prepaid supplies, cash payment follows recording of the expense.

CorrectIncorrect -

Question 37 of 50

37. Question

The following information relates to questions 37, 38, and 39:

DEF Co. uses accrual basis accounting. It pays $15,000 to cover a 3-year insurance premium and debits “insurance expense.” One (1) year has elapsed.How much insurance expense has DEF Co. incurred this year?

CorrectIncorrect -

Question 38 of 50

38. Question

The following information relates to questions 37, 38, and 39:

DEF Co. uses accrual basis accounting. It pays $15,000 to cover a 3-year insurance premium and debits “insurance expense.” One (1) year has elapsed.How much has DEF Co. paid for insurance this year?

CorrectIncorrect -

Question 39 of 50

39. Question

The following information relates to questions 37, 38, and 39:

DEF Co. uses accrual basis accounting. It pays $15,000 to cover a 3-year insurance premium and debits “insurance expense.” One (1) year has elapsed.What is the adjusting journal entry (omitting dollars) after 1 year?

CorrectIncorrect -

Question 40 of 50

40. Question

What type of account is Prepaid Insurance?

CorrectIncorrect -

Question 41 of 50

41. Question

Your company buys office supplies and debits Supplies On Hand for $10,000. At year end, you estimate that you used $4,000 of these supplies. What is the expense for supplies used?

CorrectIncorrect -

Question 42 of 50

42. Question

Generally, an adjusting journal entry . . .

CorrectIncorrect -

Question 43 of 50

43. Question

Your company, which uses accrual basis accounting, pays $18,000 in advance to cover a 3-year insurance premium and debits Prepaid Insurance. How much insurance expense has your company incurred after 1 year has elapsed?

CorrectIncorrect -

Question 44 of 50

44. Question

If bad debt is estimated as 1% of credit sales, the adjusting entry for bad debt expense includes a debit for . . .

CorrectIncorrect -

Question 45 of 50

45. Question

If your company estimates that it will not collect 5% of its accounts receivable, the year-end adjustment to Allowance For Doubtful Accounts will be . . .

CorrectIncorrect -

Question 46 of 50

46. Question

If December 1, your company opens for business and leases space in a building for $1,000 per month and pays 3 months’ rent in advance. On December 31, the balance in Rent Expense is $3,000, it means that the advance payment for rent was recorded in . . .

CorrectIncorrect -

Question 47 of 50

47. Question

Your company accrued $20,000 of salary expense at the end of Year 1, then paid $30,000 of salaries early in Year 2. How much salary expense applies to Years 1 and 2, respectively?

CorrectIncorrect -

Question 48 of 50

48. Question

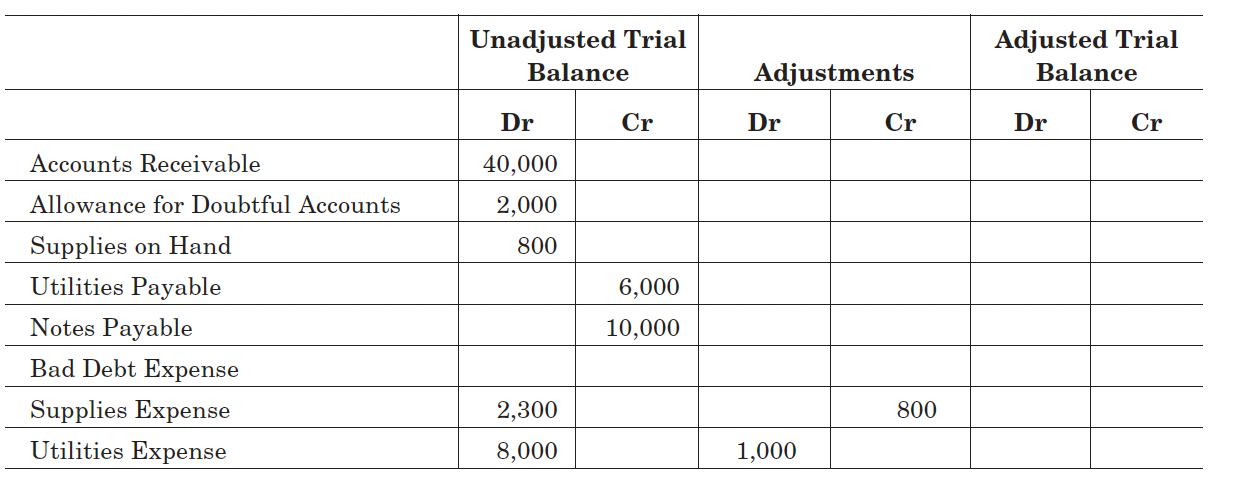

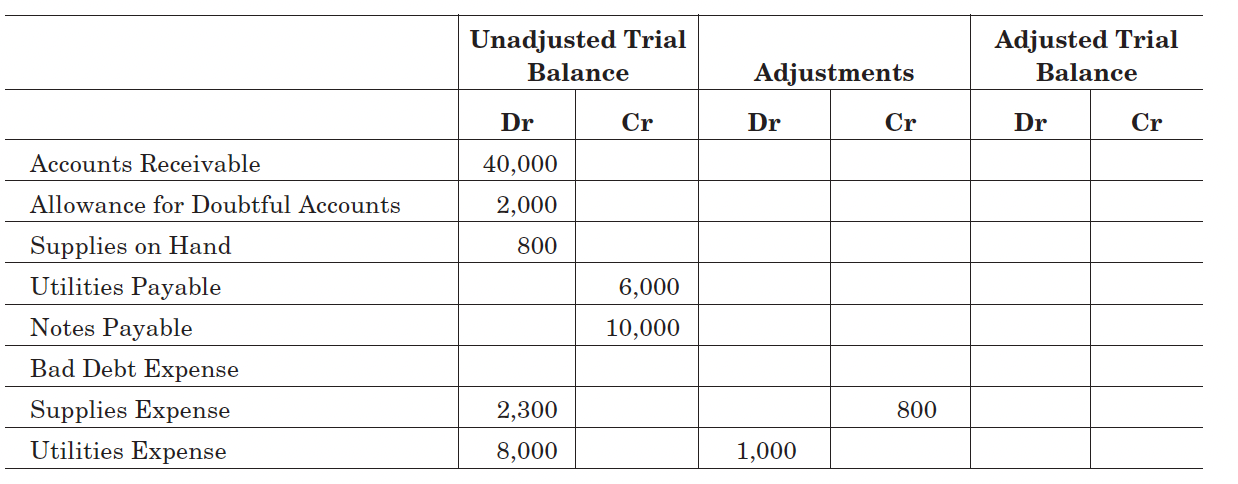

Use the following information to answer Questions 48–50:

If the partial adjustment shown for Utilities Expense is correct, what would be the adjusted trial balance amount for Utilities Payable?CorrectIncorrect -

Question 49 of 50

49. Question

Use the following information to answer Questions 48–50:

If the adjustment shown for Supplies Expense is correct, what is the adjusted trial balance amount for Supplies on Hand?

CorrectIncorrect -

Question 50 of 50

50. Question

Use the following information to answer Questions 48–50:

If the company estimates that it will not be able to collect 3% of accounts receivable, the debit to Bad Debt Expense in the adjustments column is . . .

CorrectIncorrect